The story behind the numbers: smart protein investments in India

At GFI India, we are often asked about the relevance of the smart protein sector for a majority population of vegetarians. The fact remains, that with a rapidly growing population, increasing disposable income and upward social mobility, the demand for protein is steadily increasing – with over 77% of Indians today identifying as non-vegetarian. With an aim to serve this burgeoning demand, alternatives derived from crop ingredients and cellular agriculture present compelling solutions to both sustainability and food security.

Meat the future

The sector as we know it today, had its origins in the launch of the Beyond Meat and Impossible Burger in 2007. While high-protein, “vegetarian” meat has been around for thousands of years, the launch of what was touted as the game-changing ‘plant-based meat’ burger, created a paradigm shift in the way we think about protein production and consumption. The category that has now come to be known as alternative proteins or smart proteins as we like to call them in India, spans plant-based, fermentation-derived, and cultivated proteins (derived from animal cellular agriculture). Instead of encouraging consumers to eat less meat, directly processing plants and micro-organisms into nutritious, sustainable alternatives to meat, eggs, and dairy, now presents a conceivable and scalable opportunity to slash the climate impact of animal-based protein consumption patterns. Over the next decade – further leveraging plant science and biotechnology – we are likely to see the emergence of a third generation of smart protein ‘hybrid’ products with improved taste, functionality, and nutritional profiles – the groundwork for which is already being laid down today.

India is no stranger to the humble “meat-like” alternative with “soya nuggets,” “soya chaap”, and natural textural mimics like jackfruit. However, none of these have been able to do for the Indian consumer what meat does – satiate the craving for a juicy, tender, and flavorsome kebab. And as the trend for plant-based 2.0 moved east-ward, so has the variety in flavors, formats, and ingredients. It’s only over the last 12 months that smart protein companies have started putting a desi spin on the western patty and sausage varieties and introduced plant-based momos, kheema parathas, and “mutton” sukkas, onto our plates. Beyond culinary innovation, we are also seeing indigenous pulses and millets finally receive the recognition they deserve, driving functionality, nutrition, and diversity in ingredients for meat, eggs and dairy, keeping the consumer experience central to the choice of ingredients.

Decoding the numbers with cautious optimism

Over the last decade, a whopping $14.2 billion has been invested across technology categories into the global alternative protein category and, although there’s been a high variance over this period, investment has nearly doubled on average year on year. 2021 was a banner year for investments, with $5.1 billion invested into the category, registering an almost 60% increase from 2020 and a 400% increase from 2019 (the year Beyond Meat experienced its record-setting IPO). Total investments in 2022 however, fell to $2.9 billion, amid challenging macroeconomic and market conditions worldwide. This came as no surprise and was more or less in line with the broader FoodTech/ AgriTech funding decline of 44% (Agfunder) and an overall global funding decline of 35%. Globally, since smart proteins still represent a small sector in which a handful of raises determine annual investment figures, variation is to be expected. For example, the top ten deals (of 311 total deals) in 2022 accounted for nearly half (47% to be exact) of total deal value.

Interestingly, closer to home, companies based in APAC saw 43% year-over-year funding growth to reach $562 million in 2022. In fact, for the first time in the alternative protein sector’s history, investments from outside of North America represented the majority share of the global total (58 percent vs. 42 percent), showing that the center of gravity in ‘future food’ production is slowly but steadily shifting eastward. Despite this growing investor interest in emerging markets, virtually none of this funding trickled down to India – with smart protein startups recording a modest $17Mn investments over 2021 and 2022, across all 3 categories.

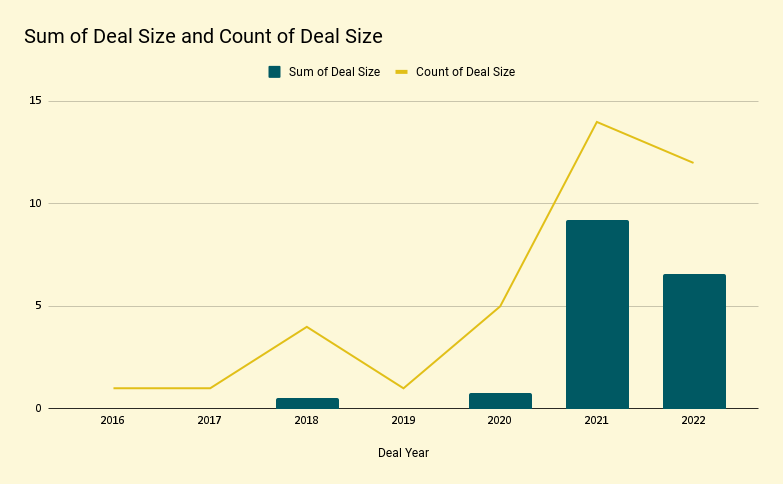

Smart Protein Investments in India

Beyond investment: the India story so far

The Indian smart protein sector today boasts of 400+ products and 60 brands working on plant-based meat, eggs, and dairy with many of them launching on shoe-string budgets in this very 2-year period. At the same time, FMCG titans like Tata Consumer Products and ITC, as well as D2C unicorn Licious – armed with big capital and deep inroads into consumer acceptance – have also launched their own line of plant-based meats, thereby demonstrating an early proof-of-concept for the sector in India.

Note: fermentation-derived and cultivated meat products are not yet available on the market in India. Fermentation-derived products require pre-market approval from the FSSAI under the ‘Approval of Non-Specified Food and Food Ingredients’ regulation. As per the current regulatory framework, novel foods such as cultivated meat should also fall within the ambit of this regulation, however, they have not been specifically defined in the regulation.

The success of the early-day products has demonstrated strong consumer interest, but investment is needed to enable alternative protein supply chain companies to build out the infrastructure needed to capitalize on this opportunity. India is presented with a unique opportunity to build globally competitive B2B companies providing ingredients and equipment to the industry – key requirements for the sector to reach crucial inflection points on scale and price globally. Beyond plant-based products, the smart proteins sector offers opportunities for the production and scaling of fermentation-derived and cultivated meat products through pre-existing infrastructure and expertise in bio-manufacturing.

These opportunities haven’t gone completely unnoticed. At the start of this year, Earth First Food Ventures (EFFV) announced a joint venture partnership with Hunch Ventures in India to build the country’s first food-tech park catalyzed by the Global Alliance for a Sustainable Planet (GASP) and the Good Food Institute (GFI). In 2022, we also saw early-signs of commercial scale facilities being set up for the plant-based sector. India-based food manufacturer, Symega Food Ingredients is investing Rs. 100 crore ($10.3 million) to build a dedicated plant-based production facility with an on-site R&D laboratory located in Kochi, India. Plant-based meat manufacturing startup, BVeg Foods unveiled its new plant-based production facility, which can currently produce 4,000 metric tons of plant-based meat a year, with plans to scale up to 12,000 metric tons/year. US-based precision-fermentation startup, Perfect Day acquired Sterling Biotech Limited (SBL) in India, whose state-of-the-art manufacturing facilities are set to double Perfect Day’s production capacity in the near term. In addition, India’s Food Safety and Standards Authority has approved the company’s application for its animal-free milk proteins, opening the door for commercialization in India.

Climate must drive long-term investment appetite in India

Climate tech in India has seen $3 Billion in equity investments since 2016 and more than half of this entire amount has been invested in 2021 and 2022 (up to November 2022) itself. As per the India Climate Finance Report published by the Climate Capital Network (CCN) in November 2022, climate is the core mandate for only 42% of those who are strategically deploying in this space. A majority of the investors surveyed are looking to deploy between $5-10Mn in the coming 12 months. There is an opportunity here for catalytic capital, completely the purview of philanthropic and impact funders with a focus on key areas such as climate and food security, to facilitate the de-risking of smart protein business models.

Alternative proteins’ status as an increasingly important ESG opportunity provides potential upside for investors and the industry. Globally, ESG interest remains high and private impact funds have $113 billion in dry powder (funds that have yet to be invested), creating a tailwind for alternative proteins. A survey conducted by the Good Food Institute of investors currently active in or entering alternative proteins shows that 99 percent of respondents are optimistic about the long-term potential of the industry, and 87 percent expect to make investments in alternative protein companies or funds in 2023. Long-term growth, technology potential, and ESG alignment provide much reason for investor optimism. Bolstered by the shifting global economic climate, investors are looking to new opportunities for doubling down on alternative proteins in emerging markets.

These developments and trends indicate that growth within this sector, like with other transformative categories, will not follow a linear trajectory and continue to vary across geographies, and that we must not misconstrue current economic conditions to underestimate long-term global growth. With the appropriate regulatory framework and government incentives, India can channel its potential manufacturing prowess, agricultural biodiversity, and ample STEM talent to support global market development.

Feature image courtesy: GoodDot